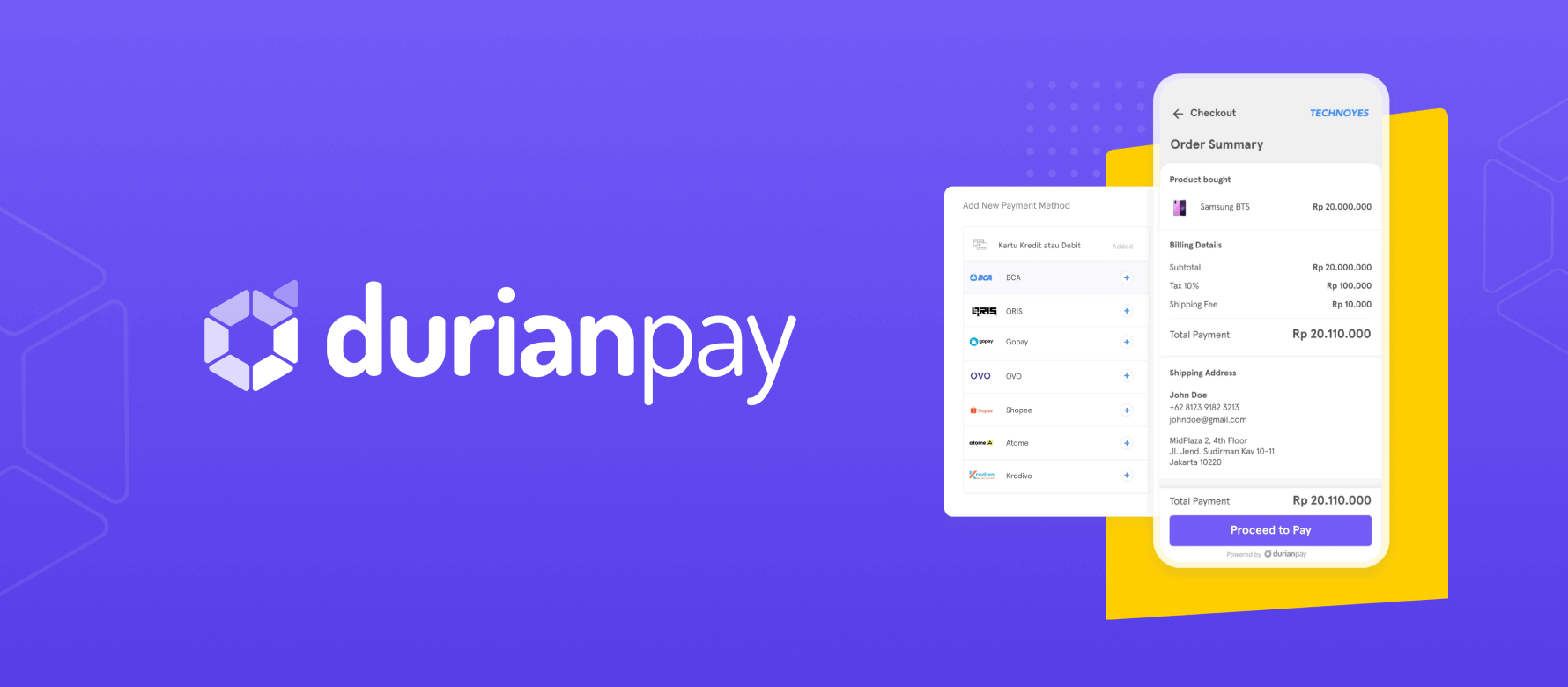

Partnering to build Indonesia’s fastest and most seamless payment aggregator platform

Durianpay takes the spotlight as Indonesia's most effective payment aggregator, serving as a comprehensive one-stop solution for all payment requirements. With a strong focus on delivering rapid and seamless payment solutions, Durianpay empowers merchants and businesses with unparalleled convenience tailored to their unique needs.

Durianpay was meticulously conceived and developed with a vision to revolutionize payment systems across South East Asia. Leveraging the expertise of Indonesia's top payment providers through a single integration, its fundamental mission is to modernize payments. This strategic approach not only enhances customer and merchant experiences but also ensures the provision of relevant services, creating a harmonious ecosystem.

Client Requirement

With a strategic approach, Durianpay carefully sought after KeyValue, confident in our ability to provide a skilled and knowledgeable team of engineers. This collaboration enabled the engineers to work closely with Durianpay's Product and Engineering teams, making valuable contributions to the company's overarching vision.

Building a Robust and User-Friendly Payment Platform

In a successful partnership with Team KeyValue, Durianpay developed a sophisticated platform that encompassed a wide range of payment processes. This all-in-one solution streamlined frictionless checkout, offered seamless integration with modern APIs, and provided a unified dashboard for efficient payment management. By connecting with top payment methods and providers through a single integration, Durianpay achieved a comprehensive and versatile payment ecosystem.

Ensuring optimal security for users was a top priority, leading to the implementation of robust measures to safeguard sensitive information. Additionally, a generic flow was meticulously constructed to facilitate the seamless integration of new provider services, ensuring flexibility and scalability for future enhancements.

Features in a glance

| Durianpay Checkout | A checkout page with different payment options from which the users can opt according to their needs. |

| Durianpay Flow | A dashboard that provides the users with analytics about their transactions and generates reports. |

| Payment Links | Lets the user create payment links from the dashboard in case of the absence of a checkout page and share the link with the customer. |

| Disbursements | The users can transfer money to their targets seamlessly just by adding the details of the recipient’s account. |

| Promotions | Create promo codes and pass them to their target customers. |

| Refunds | Refunds are made possible through the dashboard. |

The success stories continue

Durianpay now awaits Series A funding

.svg)